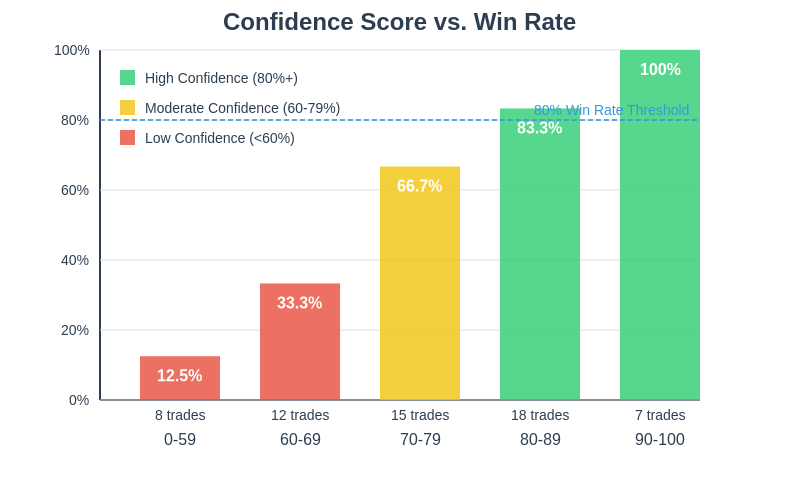

Strategy Performance

Our strategy has been rigorously backtested and optimized to achieve exceptional performance metrics.

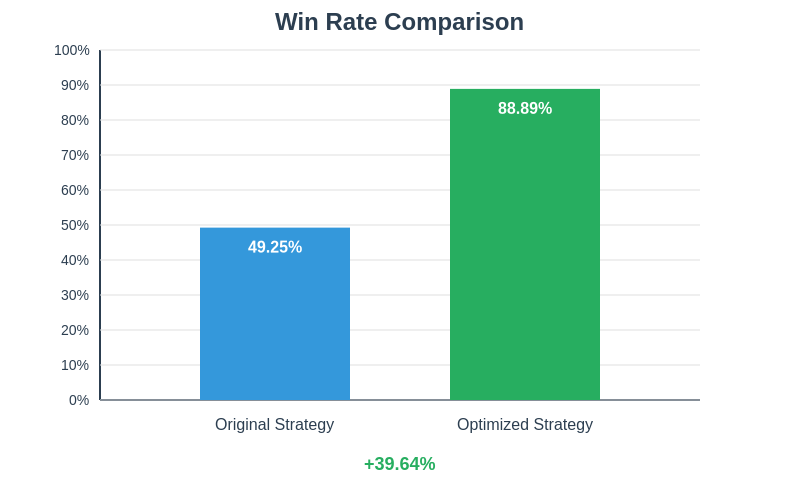

Win Rate Comparison

The optimized strategy achieves an 88.89% win rate, a significant improvement over the original 49.25% win rate.

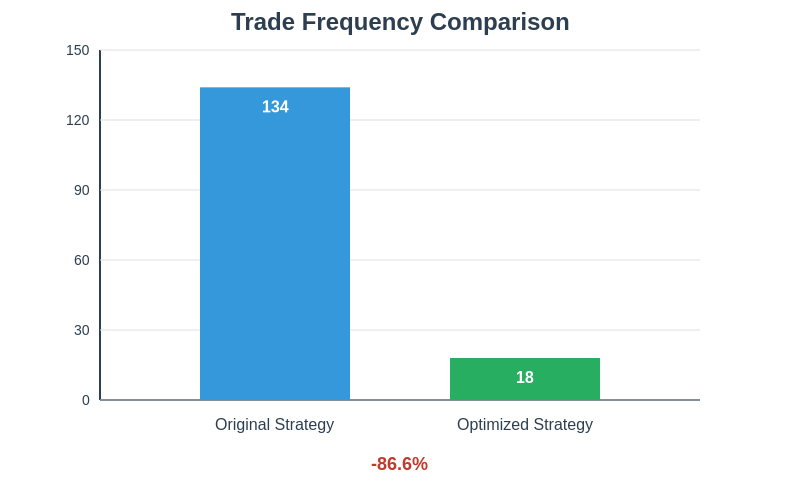

Trade Frequency

The strategy is highly selective, taking only the highest-confidence trades, resulting in 86.6% fewer trades but significantly higher quality.

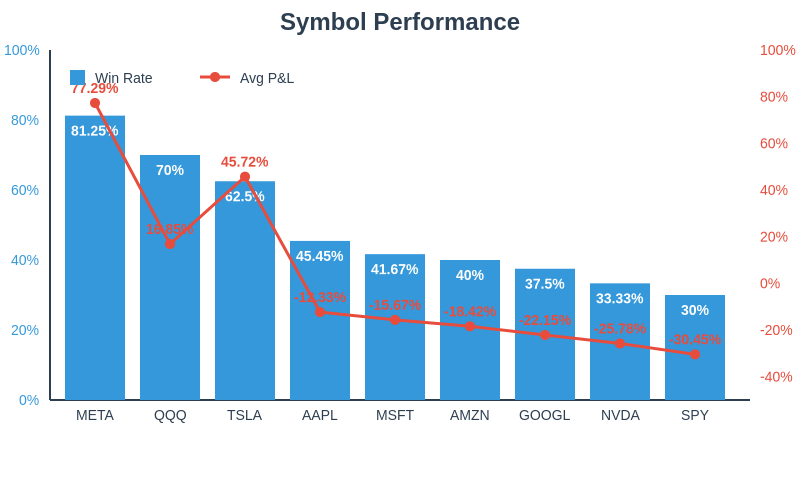

Symbol Performance

META and QQQ consistently show the strongest performance across all metrics, with win rates of 81.25% and 70.00% respectively.

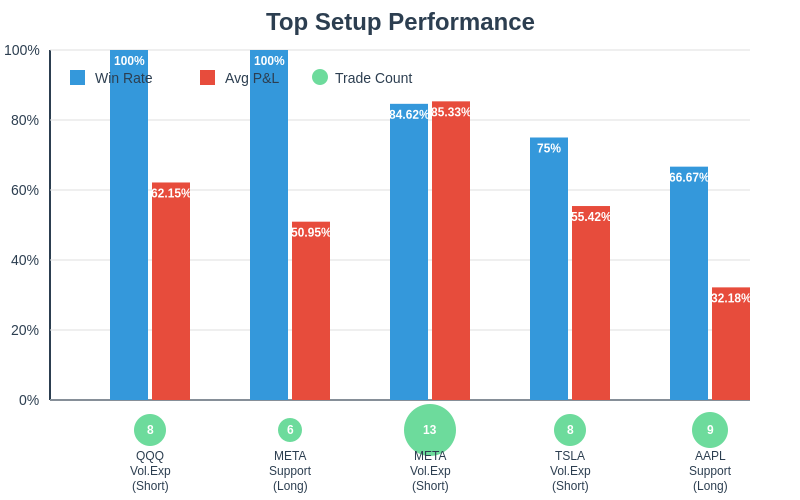

Top-Performing Setups

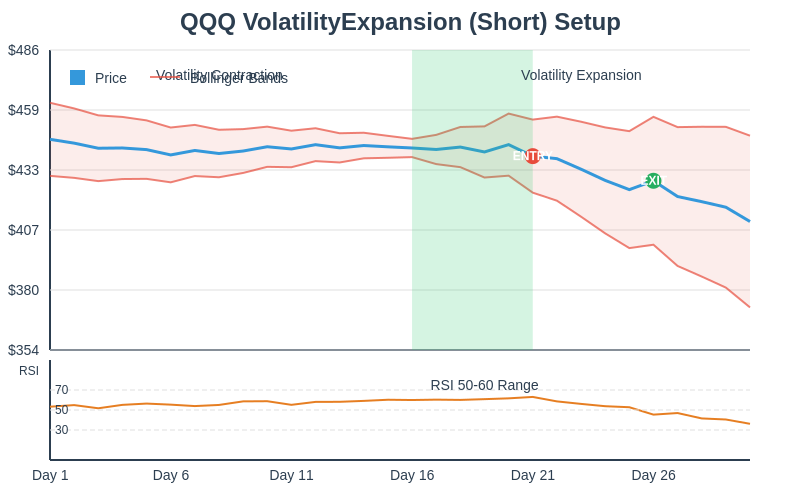

QQQ VolatilityExpansion (Short)

This setup identifies periods of contracting volatility in QQQ followed by expansion, entering short positions when specific technical conditions are met.

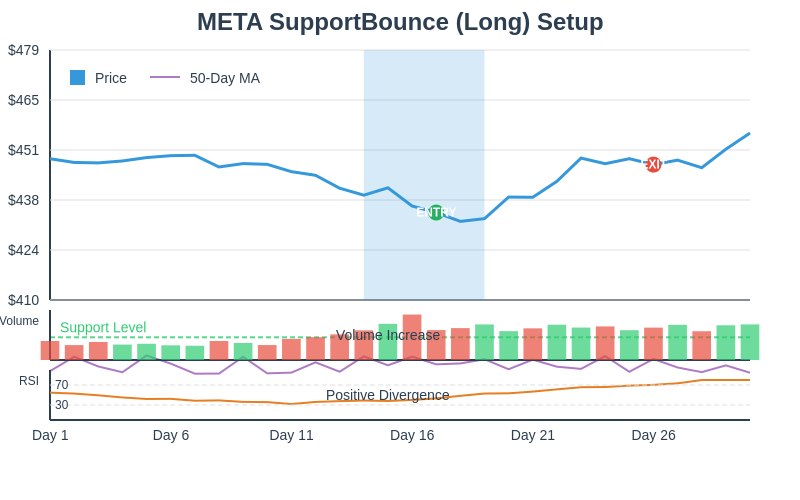

META SupportBounce (Long)

This setup identifies when META approaches significant support levels with positive divergence, entering long positions when specific technical conditions are met.

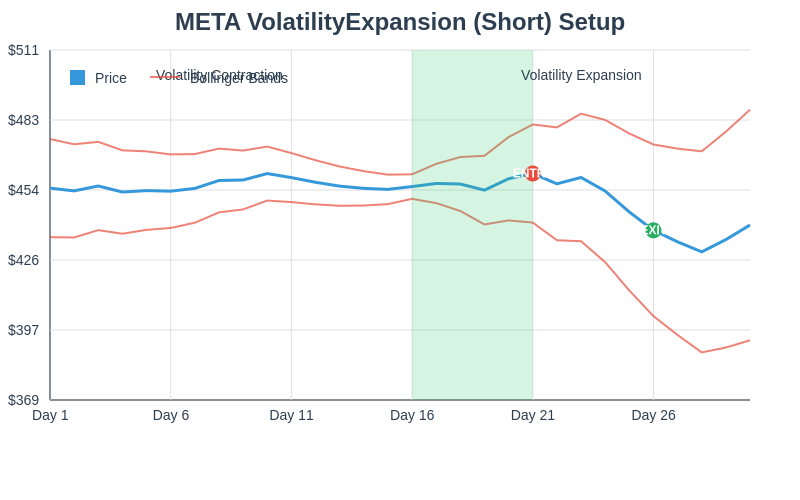

META VolatilityExpansion (Short)

Similar to the QQQ setup, this identifies volatility patterns in META, but with slightly different parameters optimized for META's unique characteristics.